// *Side note: Provided that I’ve been constantly using AI for many of my posts and inquiries for many months and years, I do want to write my own thoughts every now and then. I will continue to share conversations with AI, or link them under posts that are noteworthy, and/or synthesize its insights into my own words. A hybrid between AI and me seems ideal in my view.

The return of Michael Burry (Cassandra), the man who predicted 2008 by shorting the housing bubble, has piqued my interest lately. He’s gone silent for some years from posting on X.com (formerly Twitter), and there are tons of random imitative Burry accounts that either stalk his tweets by screenshotting and reposting them or track his investment portfolio. I came across his story ever since seeing The Big Short, like many others, I bet. I wanted to know who the real person that Christian Bale portrayed in the film and watched videos on YouTube where Burry was in, such as the 60 Minutes episode on The Big Short and his lecture on the financial crisis. One of my favorite appearances featuring Dr. Burry was his 2012 UCLA commencement speech.

I was especially following Burry’s account during the 2021 peak mania levels of the market post the January meme stock squeeze earlier that year, when stocks like GameStop shot up to ~$500 a share. 2021-2023 was a time I did deep dives to fully understand financial markets, the economy, financial crashes, and more. I still continued in 2024 and 2025, but it took a real nose-dive since I’ve done it extensively already; it gets tiring, so I had to switch it up to other topics of interest.

Don’t get me wrong, there’s so much ground and interesting stories in financial history that one could spend a lifetime studying it without getting truly bored. One could see how following the market in real time or analyzing stocks and companies can also be intellectually stimulating. Hedge fund managers like Burry, who’s on the autism spectrum, find they’re at home when playing this complex game with so many moving pieces.

Funny enough, Michael Burry blocked me from my main X account. Before his return, I was unable to see his posts until now. I followed others who reposted his tweets. I think at first I took the block personally since I was new to Twitter, but then I let it go, and didn’t take it personally. I could speculate why he blocked me, but it doesn’t matter. The one time I engaged with his post was when I was being critical of one of his social stances and political views. I was never malicious or attacked him personally, but simply critiqued some of his blind spots when it came to social matters. That’s probably one of the main reasons why I was blocked, other than looking like a spam/bot account. Now I can see his official public account and posts, but unable to interact with it on X.

I’d be lying if I said I wasn’t using Artificial Intelligence or LLMs to help me interpret some of Michael Burry’s tweets because he can be quite cryptic at times. When he returned, I did use ChatGPT, and in particular, OpenAI’s Web browser Atlas, so it could easily see the same webpages I’m looking at. I must add, this is quite a good direction for OpenAI for users to use a browser that ChatGPT can collaborate with in some way, although ChatGPT isn’t fully capable of seeing the images on a website, to my knowledge, unless one uploads screenshots, etc.

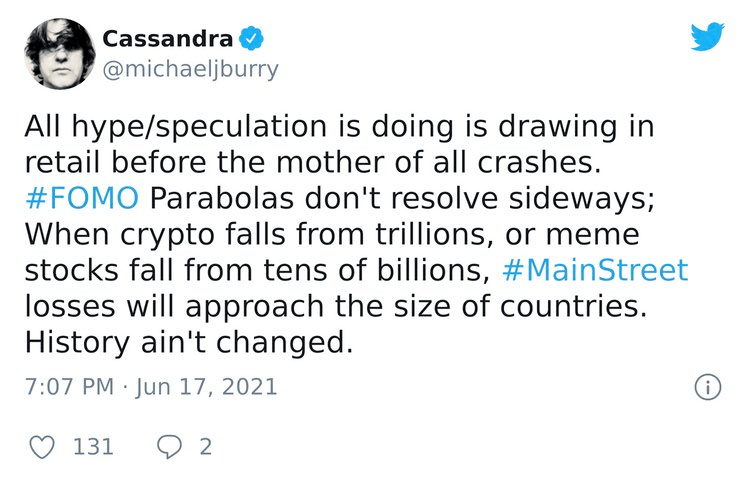

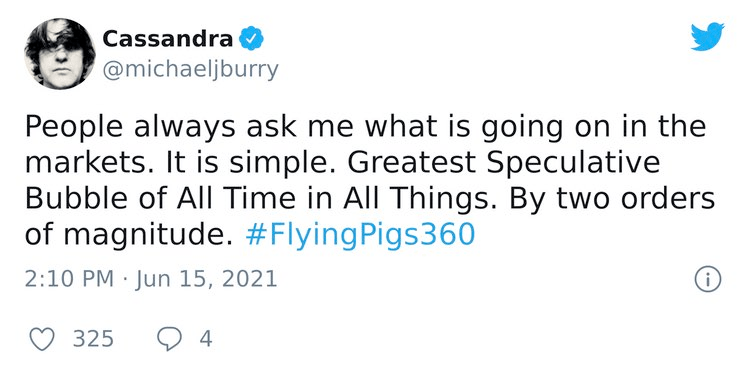

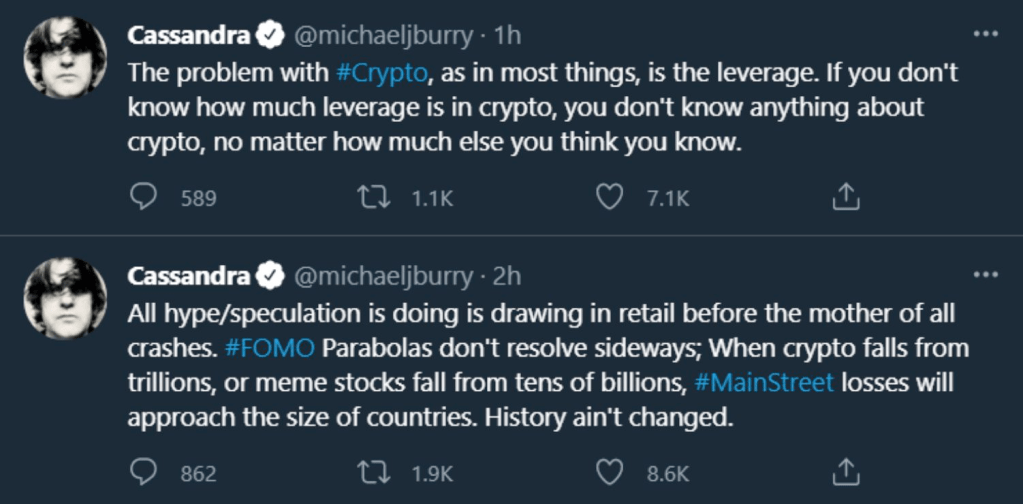

Below are some of the tweets Michael Burry posted in 2021 (from Google images) that obviously had everyone’s attention, including the mainstream media, which likes to publish stories of his positions and views, often falsely misreporting his stock positions.

As you can see, these tweets are extremely dire and hyperbolic if prophecy turned true, especially saying, “The Mother of All Crashes,” and “the losses will approach the size of countries.” These tweets are not mincing words at all. At the time, I shared the same sentiment as Burry to a degree. In hindsight, a crash did occur, but not to the scale or degree Burry predicted. Meme stocks like GameStop and AMC did rally in June of 2021, as they did in late January, and crashed soon after.

https://www.cnbc.com/2021/07/01/michael-burry-reportedly-says-meme-stocks-are-set-to-crash.html

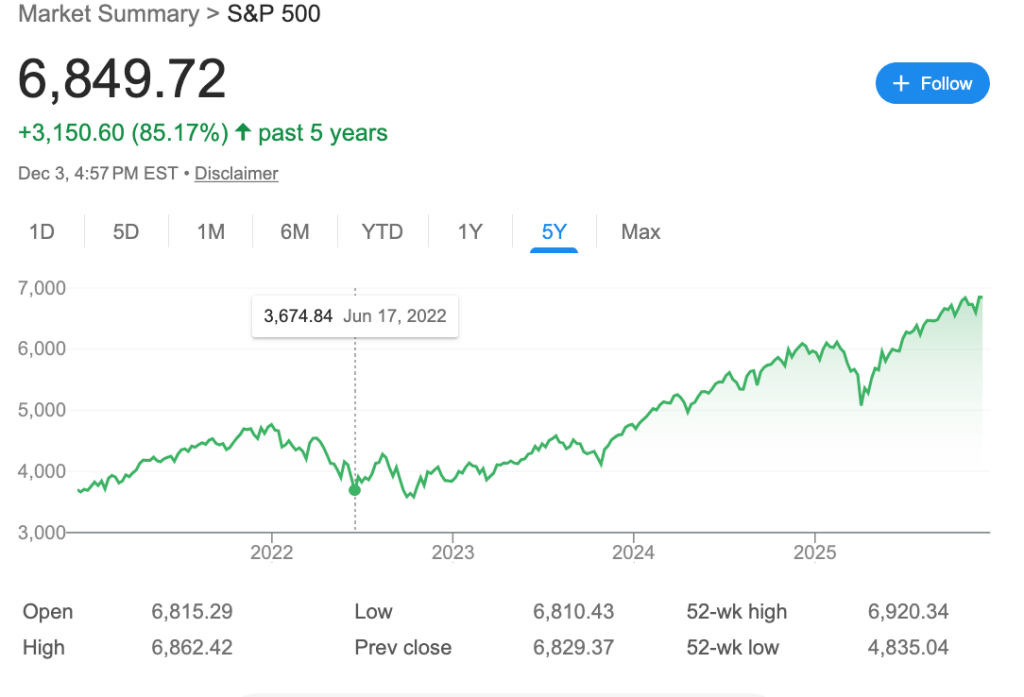

However, as you can see in the image below, the S&P 500 dropped hard in June 2022, nearly a year later, only to rebound to record highs. In other words, people often say that equities (stocks) are best to hold long-term, while forgetting all the daily swings and short-term movements. In hindsight, this begs the question whether Michael Burry’s prophecies were wrong (at least partially or mostly) from his June tweets, or if he was extremely early.

Michael Burry is often mocked by some for being early, perhaps too early, for his calls/predictions. Michael Burry was given the name “Cassandra,” apparently by Warren Buffett himself. Cassandra comes from Greek mythology, and according to a quick Google AI overview, Cassandra was a daughter of King Priam of Troy who was granted the gift of prophecy by Apollo but was cursed so that no one would ever believe her predictions.

To give Burry grace and his flowers, he did profit handsomely for shorting and calling the housing asset bubble, placing his bets early in 2005-06. He did this by helping Wall Street create these special financial instruments called Credit Default Swaps (CDSs) to specifically short what he believed would default, that was, the bad mortgage bond securities (MBSs), which were also bundled up in collateralized debt obligations (CDOs).

Steve Eisman, another character played by Steve Carell in The Big Short, simplified the main factors of the 2008 financial crisis in layman’s terms in a recent video that’s worth a listen. Seriously, he is one of the folks who explained it best. The four pillars that caused the 2008 crisis, according to Eisman, were (1). High Leverage, (2). A Major Asset Class Blowing Up (e.g., housing), (3). Systemically Important Institutions Owned the Bad Paper, and (4). Derivatives (The Invisible Web That Connected Everyone to Everyone). Derivatives, in Eisman’s view, are what made 2008 special compared to other bubbles since it was these financial instruments like Credit Default Swaps that made systemically important banks interconnected like a spiderweb around the whole world, where if one fails, that could cascade into another, and then another to fall, and so forth. This is the main reason why Warren Buffett called derivatives “financial weapons of mass destruction.”

In this crazy story, it is not that Burry is the big bad villain short seller for betting against supposedly safe mortgage bonds failing. He dug into the underlying mortgages and concluded that the whole structure was fragile and misrated. In other words, he did his due diligence, did the math, and took a risk or gamble with skin in the game to see that people in the U.S were getting high on their own supply, quit literally and figuratively. Homes were all the rage. Wall Street had sliced mortgages into complex securities, stamped huge chunks of them with AAA ratings, BBB ratings, and down the line, etc, and sold them around the world on the assumption that “home prices never go down.” Until inevitably the system imploded into itself, and like dominoes, spilled over into a serious global financial crisis. Oh, the drama; you couldn’t write a better script!

Now, profiting from people’s suffering or delusion is an entirely valid criticism, as Michael Burry did, and should be ethically examined. Market exuberance and irrationality need balance, hence a contrarian trader like Burry in this situation is expected to burst people’s bubble, pun intended (again metaphorically and literally). However, in the aftermath of the 2008 financial crisis, many bystanders got hurt, and many more would have been affected had the Fed not stepped in by hosing down the burning inferno. Granted, this wasn’t necessarily Burry’s fault, but several confluent factors created the perfect storm for a financial crisis, which in turn created an economic tsunami that wiped many people out, destroying wealth that was built on sand, leading to the Great Financial Recession with high unemployment. The political turmoil that ensued was equally a massive consequence of the rise of populism and the mistrust of public and private institutions.

Moreover, Burry was an early investor in GameStop in 2019 and sold it right before it rallied viciously in a squeeze that made Keith Gill, aka DeepFuckingValue, aka Roaring Kitty, famous. Reddit apes would probably correct me and say it was not a short squeeze, and would be akin to “sneeze” (due to timeouts of the financial system to discontinue or halt trading from the buy/long side altogether, even if it was for a short amount of time. I don’t believe Michael Burry could have predicted the insanity or outcome in GameStop stock, in the same way he likely didn’t think the fall of the housing market would turn into a full-blown catastrophic global meltdown. Yet, both of these investors, including the new CEO, Ryan Cohen, saw the deep-value-investing play in GameStop stock long before many others did. Burry was clearly early again, like 2008, except this time he misstimed his gains by selling early. Yet DFV remained, gambled via options, and still owns a massive position of the stock to this day. As my fellow apes would say, “If he’s still in, I’m in!”

One user’s name on X puts it plainly what the return of Michael Burry means, “It’s a Bubble.”

In Part 2, I will go over Michael Burry’s thesis on the AI bubble.

Another random side note. Earlier this year, I believe I made a post about a high chance of recession in the fall or late 2025. My prediction was totally off as well. Making predictions or prophesying is actually difficult. I did make the caveat that I could be wrong. No one should ever take financial advice from me, clearly.