// Tools used for this post: Perplexity Deep Research, ChatGPT Deep Research, and ChatGPT 4o.

Introduction.

In February 2025, a seven-minute TikTok video posted by Rachel Nieves, co-owner of Buddies Coffee Roasters in Williamsburg, Brooklyn, sparked a national conversation about gentrification, small business survival, and Latino cultural preservation in rapidly changing urban landscapes. I came across the video via Instagram, and was intrigued by stories such as these, like the one I did on the viral homeless UCLA professor. The viral clip — viewed over 6.7 million times — showed Nieves tearfully explaining how a proposed 40% rent increase threatened the closure of her Puerto Rican-owned café, which had become a neighborhood institution since its 2020 founding.

From Pandemic Hustle to Neighborhood Anchor

Founded in December 2020 by Rachel Nieves (née Rose) and professional skateboarder Taylor Nawrocki, Buddies Coffee began as a 15-pound-per-week coffee cart operation23. The couple, who met through New York’s underground car modification scene, initially bonded over shared frustrations with corporate coffee chains’ dominance25. “We wanted a space that reflected our communities — skate parks, auto shops, Puerto Rican kitchens,” Nieves recalled in a 2024 interview3. Their $8,000 startup budget funded a refurbished espresso machine and green coffee beans sourced directly from women-owned farms in Colombia and Puerto Rico.

The timing appeared precarious — New York City’s food service sector had contracted by 32% during COVID-19 lockdowns — but the partners leveraged Nawrocki’s skate industry connections and Nieves’ self-taught roasting skills to build a niche clientele35. By mid-2021, weekly bean sales reached 150 pounds, enabling them to lease a 400-square-foot storefront adjacent to Supreme’s Williamsburg flagship5. The location proved strategic, attracting Supreme shoppers and skateboarders drawn to Nawrocki’s streetwear-inspired interior design: exposed brick walls adorned with skate deck art, repurposed auto parts as light fixtures, and a countertop made from a dismantled 1993 Honda Civic hood25.

Operational Philosophy: Intimacy Over Scale

Contrary to conventional café expansion models, Nieves deliberately maintained what she termed “micro-community” operations. The shop eschewed digital ordering kiosks and limited seating to six stools to encourage conversation3. “Corporate chains optimize for throughput — we optimize for connection,” she explained in a 2024 industry panel3. This philosophy extended to staffing: all five employees received profit-sharing bonuses and participated in sourcing decisions, with baristas trained to memorize regulars’ orders by the second visit4.

A 2022 study in the International Journal of Hospitality Management validated this approach, finding that independent cafés with under 800 square feet had 23% higher customer retention than larger competitors, largely due to perceived authenticity3. Buddies capitalized on this by hosting weekly “cupping sessions” where patrons tasted experimental roasts and voted on which blends to commercialize4. One such session birthed their best-selling “Bodega Blend” — a medium-dark roast combining Dominican and Puerto Rican beans, designed to evoke the flavor profile of traditional New York corner store coffee4.

Founders’ Backgrounds: Synergizing Subcultures

Taylor Nawrocki: Skateboarding’s Influence on Retail Design

Nawrocki’s 12-year professional skating career (2008–2020) with brands like Chocolate Skateboards directly informed Buddies’ spatial aesthetics and marketing5. The café’s layout deliberately mimics skatepark flow — low-slung concrete benches allow for board tricks, while angled mirrors enable visibility from all seating areas, a feature Nawrocki adapted from skate spot surveillance practices5. “In skating, you’re always scanning for security guards and smooth ledges. I wanted customers to feel that same alertness but in a welcoming way,” he told Jenkem Magazine in 20245.

This subcultural infusion extended to merchandise. Limited-edition coffee bags featured graphics by skater-artists like Mark Gonzales, while a 2023 collaboration with Vans produced sneakers with soles printed with coffee bean texture patterns5. Such initiatives boosted non-beverage revenue to 35% of total sales by 2024, compared to the industry average of 15%3.

Rachel Nieves: Bridging Coffee and Boricua Identity

Nieves’ journey from Queens auto shop manager to coffee entrepreneur reflects broader trends in Latina-led small business growth — a demographic that saw 87% expansion in NYC between 2019–2024, per CUNY’s Center for Latin American Studies3. Her self-taught roasting methodology combines Puerto Rican tradition with third-wave precision:

Agro-ecological bean selection + Nuyorican flavor profiles = Distinctive terroir

For instance, her “Cafecito Oscuro” roast uses a 72-hour anaerobic fermentation process adapted from Puerto Rican rum production, yielding notes of tamarind and toasted coconut4. This hybrid approach earned Buddies a 2023 Good Food Award, making Nieves the first Latina roaster honored in the competition’s 14-year history3.

Pandemic-Era Growth and Adaptive Strategies

Survival Through Community Mutual Aid

When COVID-19 restrictions suspended foot traffic in early 2021, the partners implemented a three-pronged survival strategy:

- Skate-Delivery Network: Nawrocki mobilized local skaters for contactless deliveries, paying them in coffee credits and custom grip tape5. At its peak, this fleet completed 120 daily orders across Brooklyn.

- Virtual Roasting Classes: Nieves hosted Instagram Live sessions teaching home brewing techniques, which attracted 4,000+ viewers per episode and converted into $28,000 in equipment sales4

Pay-It-Forward Program: Customers pre-purchased $6,300 in “suspended coffees” for frontline workers, later expanded to fund community fridges during 2022’s inflation crisis3.

These initiatives stabilized revenue at 68% of pre-pandemic levels — outperforming NYC’s overall restaurant sector recovery rate of 54%3.

Technological Integration Without Automation

Contrary to the industry’s push toward app-based ordering, Buddies maintained analog operations. Orders were handwritten on recycled skateboard grip tape, while a 1980s Casio register handled transactions5. This Luddite approach, initially criticized, became a marketing asset — TikTok videos of Nieves manually grinding beans garnered 12 million views in 2023, driving a 19% increase in tourist visits1 4.

Cultural Significance: Preserving Puerto Rican Identity in Gentrified Brooklyn

Williamsburg’s Shifting Demographics

The café’s location at 132 Grand Street places it in a census tract where the Hispanic population dropped from 63% in 2000 to 29% by 2020, displaced by luxury condos and tech offices13. Nieves, whose family migrated from San Juan to Queens in the 1980s, intentionally positioned Buddies as a cultural bridge. Seasonal specials like “Coquito Latte” (a non-alcoholic take on the Puerto Rican holiday drink) and art exhibits featuring Boricua photographers drew both diasporic patrons and curious newcomers4.

Economic Impact Metrics

A 2024 NYU Stern School study estimated Buddies’ annual neighborhood economic impact at $2.3 million through:

- Local Sourcing: 73% of ingredients (including milk from Battenkill Creamery and pastries from La Marqueta bakers) purchased within 10 miles3.

- Employment Multiplier: Each café job supported 2.3 ancillary positions in cleaning, bean supply, and maintenance services3.

- Tourism Draw: 18% of customers traveled from outside NYC specifically to visit the shop, spending $142 daily on average in adjacent businesses3.

Existential Threats: The 2025 Rent Crisis

Lease Negotiation Breakdown

Buddies’ original 2020 lease — $8,500/month for 400 square feet — ballooned to $14,000 by 2024 as the building’s new ownership group implemented annual 12% increases6. Negotiations stalled in January 2025 when landlords demanded $19,500/month, citing comparable rates from a Blue Bottle Coffee outlet opening nearby16. Nieves’ TikTok disclosure of these terms triggered a national backlash against “predatory commercial rent hikes,” with the hashtag #SaveBuddies trending for 72 hours16.

Viral Advocacy and Celebrity Solidarity

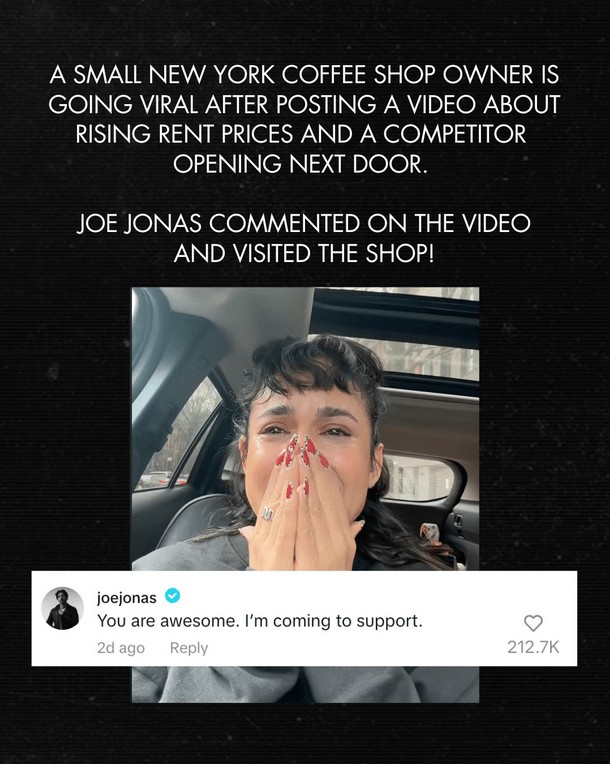

The video’s emotional resonance stemmed from its juxtaposition of corporate encroachment and cultural erasure. Comments from Puerto Rican users like @marisol_vega (“They’re not just raising rent — they’re erasing our history”) underscored the racialized dimensions of urban displacement1. Celebrity interventions followed:

- Joe Jonas visited on February 28, 2025, ordering 87 coffees for film crews, which crashed Buddies’ POS system1.

- Bad Bunny reposted the video to his 45 million Instagram followers, leading to $42,000 in online orders within six hours13.

- Congresswoman Nydia Velázquez pledged to fast-track the Small Business Rent Stabilization Act, inspired by Buddies’ plight6.

What followed the viral video was an outpouring of real-world support that even Rachel could never have imagined. In the days after the TikTok blew up, customers lined up down the block to get a cup of coffee from Buddies and show solidarity greenpointers.com fox5ny.com

Over the first weekend post-video, the tiny cafe saw crowds so large that the owners eventually had to cut off the line to manage the demand greenpointers.com. On one of those days, by 11 a.m. they had completely sold out of the coquito latte — the drink had become a must-try symbol of the shop, thanks to all the social media attention gothamist.com gothamist.com.

Longtime regulars and first-time visitors alike didn’t mind waiting; one regular noted she was actually happy to see a line, saying it was “amazing that people can rally so quickly and enthusiastically for small businesses when they need help” gothamist.com.

The community support spanned all kinds of New Yorkers. Neighborhood residents who ordinarily might have walked by came in to spend a few dollars on a latte to help out. Some traveled from other boroughs or even out of state — one supporter drove in from New Jersey after seeing the video brooklyn.news12.com.

For Puerto Rican and Latino community members, Buddies’ fight felt personal. “Being a Puerto Rican myself, I had to come show up… to support a small business that is Puerto Rican-owned in Brooklyn,” one woman said, who came with her mother from across the city to visit Buddies, noting that the shop stands in the same neighborhood her mom grew up in decades ago gothamist.com gothamist.com.

Such stories were common, as people recounted ties to Williamsburg’s past or simply a desire to “restore your faith in humanity” by helping a neighbor fox5ny.com fox5ny.com.

This grass-roots surge in customers translated into a huge boost in sales for Buddies Coffee — both in-store and online. The sudden spike in online orders for Buddies’ roasted coffee beans and merchandise was so large that the shop’s website posted a notice warning of 2–3 week delays in fulfillment due to the flood of support hoodline.com gothamist.com.

In other words, the community’s response not only lifted Rachel’s spirits but also temporarily improved the café’s financial outlook, at least in the short term.

Crucially, it wasn’t just everyday customers who took notice — high-profile figures and brands joined the cause as well. The most famous boost came from pop star Joe Jonas, who dropped by Buddies in person and later posted a TikTok of himself at the cafe gothamist.com. In his video, he encouraged people to “be a buddy” and support the shop, which brought even more attention from his fans. Television personality and entrepreneur Bethenny Frankel (of Real Housewives fame) also chimed in, commenting on Rachel’s post and reaching out to learn more about the situation gothamist.com

Other celebrities and influencers followed suit: media personality Tefi Pessoa and even a natural products brand, Raw Sugar, publicly showed support for Buddies belatina.com

Social media channels lit up with the hashtag #BuddiesCoffee and messages urging New Yorkers to visit the shop. This kind of celebrity signal-boosting helped validate the cause and drew in people who might not even live in Brooklyn but wanted to contribute by ordering coffee online or simply spreading the word.

Thanks to this combined community and celebrity support, Buddies Coffee has, for the moment, been “celebrated as a success story by the community it serves,” even in the face of its challenges gothamist.com.

The experience has been bittersweet — Rachel is grateful and overwhelmed by the love (“so many wonderful people have shown up and shared, and just thank you,” she said in a follow-up video gothamist.com), yet the fundamental obstacles of rent and competition remain. Still, the outpouring proved that New Yorkers will rally to help a beloved small business, and it gave Rachel a much-needed sense of hope and validation. As one customer put it, seeing everyone come together “kind of restores your faith in humanity a little bit”fox5ny.com.

Path Forward: Sustainable Scaling vs. Core Values

Expansion Dilemmas

Despite multiple offers to franchise, Nieves insists on “controlled growth anchored in cultural integrity”3. A planned second location in Spanish Harlem will prioritize partnerships with public housing resident associations, offering barista scholarships to low-income teens3. However, logistical challenges persist — shipping 200+ pounds of weekly online orders now requires outsourcing production, risking quality dilution4.

Social Media Facade

Surface level hypocrisy to support a small business owner, and not address the systemic issue and the larger economic forces at play.

A lot of the commentary on this story overlooks the bigger picture. While some might see Rachel’s emotional response as dramatic, I think it’s important to recognize the very real struggles that small business owners face — especially in high-cost cities like New York.

This isn’t just about one coffee shop. It’s about a broader trend where rising rents, corporate expansion, and economic forces increasingly push out independent businesses and displace working people, especially blacks and latinos. And at the root of these challenges are policies that have artificially inflated real estate values, distorted market dynamics, and contributed to long-term affordability issues.

One of the biggest factors at play? Federal Reserve policy and commercial real estate economics.

- In 2020, during the pandemic, the Fed injected trillions into the economy, buying up mortgage-backed securities (MBS) and keeping interest rates near zero. This made borrowing cheap for landlords, investors, and corporations, fueling real estate speculation.

- Institutional investors, hedge funds, and REITs (Real Estate Investment Trusts) took advantage of these low rates to buy up properties, expecting continued appreciation.

- As a result, commercial landlords have had no incentive to lower rents, even when small businesses struggle.

- When inflation started surging, the Fed aggressively raised rates in 2022 and 2023, making it harder for property owners with floating-rate mortgages to cover their costs — so they passed those costs onto small business tenants through rent hikes.

For a business like Buddies Coffee Roasters, this is a perfect storm:

- The lease is expiring at a time when landlords are raising rents to offset higher mortgage costs.

- A corporate coffee shop is moving in next door, likely backed by investors who can absorb short-term losses to outcompete local businesses.

- The original community that once defined Williamsburg — Puerto Rican and working-class residents — has been steadily displaced, reducing the local customer base that might have supported a business like Buddies.

Rachel is expressing what many small business owners feel: the system is rigged against the little guy. Not because of any single bad actor, but because the economic policies that shape these markets overwhelmingly favor large investors, corporate landlords, and speculative capital over independent businesses and local communities.

Instead of dismissing her frustration, we should be asking:

- Why is commercial real estate structured in a way that makes it nearly impossible for small businesses to secure stable, affordable leases?

- Why do policymakers intervene to protect financial markets but not to support the small businesses that form the backbone of local economies and often at their expense?

- How do we balance urban development and investment without erasing the communities that made places like Williamsburg vibrant in the first place?

This isn’t just about Rachel or Buddies Coffee Roasters — it’s about how monetary policy, gentrification, state policies, and financial speculation interact to reshape entire cities. The fact that a successful, hardworking, and culturally-rooted small business owner can’t make it work in Brooklyn is a symptom of a much deeper problem.

People showing up to support this business owner may provide temporary relief, but it does nothing to address the underlying economic issues. Her rent will continue to rise, and unless broader conditions change, she — and many others like her — will face the same fate.

She attributes her struggles to gentrification, but that’s only a small piece of the problem. The real issue runs much deeper: a monetary and fiscal system that perpetuates artificial boom-bust cycles, fuels inflation, and erodes economic stability.

This is the same flawed thinking that leads some to believe wage increases alone will solve the problem of living paycheck to paycheck. But if wages simply rise in lockstep with inflation, it doesn’t fix anything — it becomes a vicious cycle and only keeps people treading water while prices keep climbing. The root cause is the continuous devaluation of currency through reckless monetary and fiscal policy.

At the heart of this issue are central banks and governments:

- Central banks manipulate monetary policy, printing money and suppressing interest rates to keep the system propped up, creating asset bubbles and long-term distortions.

- Governments engage in reckless fiscal spending, running enormous deficits while raising the debt ceiling repeatedly — perpetuating a system where they spend far beyond their means, kicking the can down the road.

Brief US Economic History

The United States left the gold standard in two major steps: first in 1933, when President Franklin D. Roosevelt ended the gold standard for domestic transactions, devalued the dollar, and banned private gold ownership; and then in 1971, when President Richard Nixon ended the convertibility of the U.S. dollar to gold for foreign governments, effectively dismantling the Bretton Woods system.

The Bretton Woods Agreement of 1944 had established the U.S. dollar as the world’s reserve currency, pegged to gold at $35 per ounce, while other currencies were pegged to the dollar. However, by the late 1960s, rising inflation and global demand for gold made the system unsustainable, leading to the Nixon Shock in 1971, which marked the beginning of the modern fiat currency era.

The gold standard was the last guardrails that restrained government overspending. Without that check, the government now operates on unlimited credit, funding its spending with ever-increasing debt and inflation, which ultimately erodes purchasing power and fuels cost-of-living crises like the one this business owner is facing.

The cycle is predictable:

- The government overspends → debt skyrockets.

- The Fed prints money or manipulates rates → creating artificial booms.

- Inflation kicks in → prices rise, wages lag behind.

- The middle class and small businesses get squeezed while big corporations and asset holders benefit.

- The system crashes → prompting more intervention, starting the cycle again.

Rachel’s story is just one example of how small businesses become collateral damage in this flawed economic system. While community support is admirable, it won’t stop rising commercial rents, inflated asset prices, or the broader wealth transfer that benefits large investors at the expense of small business owners and working people. Yet everyone, including large corporations, lose when the government acts irresponsibly. If giant corporations hold on to large sums of cash and don’t invest it, their money erodes due to long-term inflation (check Warren Buffett’s latest Berkshire Hathaway letter to shareholders).

Instead of focusing solely on gentrification, the real discussion should be about how we fix a system that incentivizes financial speculation over real economic stability, and make governments or quasi-governments and the administrative state accountable for their actions.

Analogy: The Gold Standard as a Speed Limit for Government Spending

Imagine the U.S. economy as a car, and the gold standard as a speed limiter that prevents the car from going too fast.

Before Leaving the Gold Standard (Pre-1933 & Pre-1971)

- The speed limiter (gold standard) kept the car’s speed in check, ensuring the government could only spend as much as it had in gold reserves.

- If the government wanted to spend more, it had to either collect more gold (raise taxes, boost exports, or produce more wealth) or borrow cautiously, knowing it couldn’t exceed the limit forever.

- This created discipline — policymakers couldn’t just press the gas pedal endlessly without real economic backing.

After Leaving the Gold Standard (Post-1971)

- The U.S. removed the speed limiter, allowing the government to spend without any hard constraint.

- Instead of being limited by gold, they could now create money out of thin air (via the Federal Reserve) and fund spending through debt issuance (Treasury bonds).

- Politicians no longer had to make tough choices — they could spend freely, knowing they could always borrow more or print more money to cover deficits.

- As a result, the car kept accelerating, but instead of growing the real economy at a sustainable pace, it piled up more debt and created inflationary pressure.

How This Changed Government Operations

- Before: To spend, the government had to earn or borrow cautiously → Economic growth was based on real productivity.

- After: The government could spend without limit, relying on money printing and debt issuance → Inflation and asset bubbles became structural problems.

The Consequences of Removing the Speed Limit

- Massive Government Deficits — Without gold backing, the U.S. piled up trillions in national debt, borrowing to fund endless wars, social programs, and financial bailouts.

- Persistent Inflation — More money in circulation without real backing led to higher prices over time, eroding purchasing power.

- Wealth Transfer to Asset Holders — Since newly printed money flows into financial markets first, the rich get richer while the middle class struggles with rising costs.

- Boom-Bust Cycles — The Fed now controls the economy artificially, leading to wild cycles of expansion (money printing) and contraction (rate hikes), instead of organic, stable growth.

By removing the gold standard, the U.S. traded financial discipline for unlimited spending power. In the short term, it allowed economic expansion, government flexibility, and global dollar dominance, but in the long term, it created inflation, skyrocketing debt, and a system where the economy relies on endless intervention to stay afloat.

Final Remarks

What begins as a genuine struggle and heartfelt story in gentrified Williamsburg, quickly gets distorted by emotional appeal, losing sight of the deeper systemic issues at play. Social media, while amplifying awareness, often prioritizes viral sentiment over substance, spreading misinformation and half-truths rather than fostering real understanding. This creates a cycle where public outrage leads to temporary support, but no real solutions, leaving the underlying economic forces unchecked. Instead of addressing the root causes, we end up with short-lived sympathy and band-aid fixes, while the same structural problems continue to push small businesses and individuals to the brink.

The Federal Reserve through Quantitative Easing (QE) backstopped large corporations and businesses during the COVID-19 lockdowns through massive liquidity injections, near-zero interest rates, purchasing corporate bonds, mortgage-backed securities (MBS), and for the first time buying Exchange-Trading Funds (ETFs)! This fueled asset bubbles, causing stocks and real estate prices to skyrocket, while everyday Americans faced rising living costs. Not only did the Fed contribute to increasing wealth inequality by inflating asset prices — disproportionately benefiting the wealthy — but it also distorted market fundamentals, making assets detached from intrinsic value and real economic productivity.

Now, the Fed has managed to tame inflation to keep it under control with Quantitative Tightening (QT). In other words, from 2022–2024, the Fed raised interest rates to tame runaway inflation from the global printing press era of the pandemic. In recent years, they have been lowering interest rates to ease the tension, and ensure a soft landing to the economy. The question is what else will break in the meantime, as we’ve seen some banks crash during 2023 and needed bailouts when interest rates rose.

I’m genuinely concerned about the lack of financial literacy and economic education in our country when a social media post goes viral, and then people start pointing the finger at different things, and not at the main culprit. They will blindly support a bill not knowing the unintended consequences if it gets passed.

All too often genuine experts are pushed to the wayside, while talking heads, celebrities, and politicians push for a bill that gets wide support and popularity like rent stabilization. Rent stabilization is a form of price control — and history has shown that price controls tend to distort markets rather than fix them. Read about the economic history of the 1970s and the era of stagflation, where soaring inflation and stagnant growth crippled the economy. One contributing factor was the government’s attempt to impose price controls on oil, which only exacerbated shortages and worsened the crisis instead of solving it.

People want to blame the rich, and #eattherich, not realizing that their very government is the ones that inadvertently make those who hold assets, and the rich, richer. We are a hypocritical nation where the blind lead the blind to their financial slaughterhouse, or in a continuous hamster wheel, or a hill that grows bigger the more you climb it. We have a class of working people and the younger generation who get the short end of the stick because they will be the ones supporting the previous generations. We will continue to enrich those who own the means of production and equities, while the older population is in retirement or close to retiring, which has a social security program that is akin to a pyramid scheme.

We are in a lose-lose situation because the system is outdated, and is set up for failure if socioeconomic conditions aren’t near perfect, and if else fails, thus entrapping us to servitude because nobody wants to fix it until Elon Musk and DOGE came along. I have my own criticisms of Musk and the DOGE team, but I know they see the same issues as I do. I want people to know of all the moving forces that go along with the economy, and that blaming one thing over another is ignorance when not considering all the moving pieces or seeing the main piece of the jigsaw puzzle, like in the microcosm of a small coffee shop and how its impacted by fiscal and monetary policies.