Introduction.

After watching an interesting video on risk management, I asked ChatGPT to go over the four concepts of risk events — Black Swan, Gray Rhino, Dragon King, and Wicked Problem. Then I asked it to figure out what was missing and it came up with the White Tiger. Maybe there is a concept that is its equivalent, but for now, I’ll stick with it since it fits in nicely.

Finance often uses animal metaphors to illustrate market behaviors and participant attitudes vividly. These metaphors help simplify complex financial and economic concepts and make them more relatable.

There is a high probability of a Dragon King-type risk event on the horizon this year in 2024 on capital markets and the economy. It is a probability and not an absolute guarantee, meaning I could always be wrong, which is, admittedly a cop-out on my end.

Concepts of risk events:

A Black Swan

Definition and Origin A Black Swan event is characterized by its extreme rarity, severe impact, and retrospective predictability. Popularized by Nassim Nicholas Taleb in his 2007 book “The Black Swan: The Impact of the Highly Improbable,” it refers to unexpected events with massive consequences. The term originates from the old belief that all swans were white until black swans were discovered in Australia in the 17th century, illustrating that unexpected events can occur even if they’ve never been observed before.

Examples

- 2008 Financial Crisis: A sudden and severe market collapse driven by the housing bubble burst and subsequent banking failures, which was largely unanticipated by most experts.

- 9/11 Terrorist Attacks: A highly improbable event with catastrophic consequences that reshaped global security policies and geopolitical landscapes.

Key Points

- Taleb argues that Black Swan events are impossible to predict but can be managed by building robustness against them.

- The focus should be on eliminating vulnerabilities and exploiting opportunities, rather than attempting to forecast such events.

Gray Rhino

Definition and Origin The Gray Rhino concept, introduced by Michele Wucker, refers to highly probable, high-impact threats that are often neglected despite being obvious. Unlike Black Swans, Gray Rhinos are foreseeable but are ignored until they charge at us, creating a crisis.

Examples

- Climate Change: A slow-moving crisis with escalating impacts, warned about for decades but often insufficiently addressed.

- COVID-19 Pandemic: Despite numerous warnings and previous outbreaks of other coronaviruses, global preparations were inadequate, leading to a rapid escalation once the virus spread.

Key Points

- Gray Rhinos arise from systemic biases and psychological comfort zones that lead to ignoring visible threats.

- Addressing these requires sufficient intelligence, diversity, and originality in threat analysis and decision-making.

White Tiger

Definition and Origin The White Tiger represents a highly visible, rare, and captivating event that, unlike Black Swans or Gray Rhinos, is generally viewed with fascination or even complacency, despite its potential for sudden, devastating impact. It draws from the metaphor of a white tiger, a rare and striking animal that attracts attention and awe but can be highly dangerous if underestimated or mishandled.

Characteristics

- Highly Visible: Unlike Black Swans (unexpected) and Gray Rhinos (neglected but obvious), White Tigers are events or threats that are well-known and closely watched because of their rarity and potential impact.

- Rare and Captivating: These events are not common and often stand out due to their unique nature. Their rarity and distinctive features attract significant attention.

- Potential for Sudden Impact: While they might be monitored closely, their potential to cause sudden and significant disruption is often underestimated due to their captivating or seemingly benign nature.

Examples

Volcanic Eruptions in Populated Areas:

- Mount Vesuvius (Italy): Well-known for its catastrophic eruption in AD 79, Vesuvius is closely monitored. Despite its known potential for future eruptions, the surrounding densely populated regions often underestimate the sudden impact it could have.

Highly Speculative Technologies:

- Quantum Computing Breakthroughs: The development of quantum computing is highly anticipated and closely watched. However, the potential for a sudden breakthrough that disrupts current encryption and cybersecurity systems is often underestimated in terms of its immediate disruptive impact.

Geopolitical Flashpoints:

- Taiwan Strait: The tension between China and Taiwan is well-known and closely followed globally. The situation is captivating and garners significant attention, but the potential for a sudden military conflict and its global repercussions are often underestimated due to the prolonged status quo.

Key Points

- Monitoring and Complacency: The attention given to White Tigers can lead to complacency, where constant visibility results in a false sense of security or inevitability without adequate preparation for the sudden impact.

- Fascination and Underestimation: The captivating nature of these risks can distract from their potential severity, leading to underpreparedness despite awareness.

Dragon King

Definition and Origin Coined by Didier Sornette, a Dragon King is a rare, extreme event that is unique in nature and sits at the top of the hierarchy in terms of impact. Unlike Black Swans, Dragon Kings can sometimes be anticipated within complex systems due to their unique precursors.

Examples

- 1987 Black Monday: The largest single-day stock market crash that wiped out years of gains, far beyond normal market volatility.

- Lehman Brothers Collapse (2008): A significant event in the financial crisis, representing a failure of a major institution with far-reaching effects.

Key Points

- Dragon Kings are the result of the complexity and interconnectedness of systems, which can lead to extreme outcomes.

- Vigilance and real-time data monitoring are essential to anticipate and respond to these events.

Wicked Problem

Definition and Origin A Wicked Problem is a complex issue that resists resolution due to its evolving nature and the interdependencies involved. The term was introduced by Rittel and Webber in the context of social policy planning in the 1970s.

Examples

- Global Poverty: A persistent issue with no simple solution, continuously evolving despite numerous interventions.

- Cybersecurity Threats: Constantly adapting and evolving, requiring ongoing innovation and collaboration to manage.

Key Points

- Wicked Problems require high levels of real-time intelligence, collaboration, and agility.

- They are characterized by their resistance to definitive solutions and continuous evolution, making them highly complex and adaptive.

More Animal Concepts:

Bulls and Bears

Bull Market:

- Symbolism: A “bull market” refers to a period of rising stock prices. The term comes from the way bulls attack by thrusting their horns upward, symbolizing the upward movement of the market.

- Characteristics: Optimism, investor confidence, and expectations of strong future performance. Typically, during a bull market, the economy is strong, and employment levels are high.

Bear Market:

- Symbolism: A “bear market” indicates a period of falling stock prices. Bears attack by swiping their paws downward, representing the downward trend in the market.

- Characteristics: Pessimism, investor fear, and expectations of continuing poor performance. Bear markets are often associated with economic downturns and rising unemployment.

Pigs

Greedy Pigs:

- Symbolism: In finance, pigs are often depicted as greedy investors who take excessive risks in the hope of large gains. The phrase “pigs get slaughtered” warns against greed and lack of discipline.

- Characteristics: Overleveraging, impulsive decision-making, and ignoring risk management. Greedy pigs often chase trends without proper analysis and tend to lose heavily when markets turn against them.

Hawks and Doves

- Hawks: In economic contexts, hawks are policymakers or economists who prioritize controlling inflation and often favor higher interest rates.

- Doves: Conversely, doves focus on stimulating economic growth and reducing unemployment, favoring lower interest rates.

Wolves and Sheeps

Wolf:

- Symbolism: Wolves, particularly in the context of “Wolves of Wall Street,” or the more familiar “The Wolf of Wall Street” movie with Leonardo DiCaprio symbolize aggressive, predatory, and often unscrupulous financial practices. They are associated with high-stakes trading and sometimes unethical behavior.

Sheep:

- Symbolism: Sheep represents investors who follow the crowd without independent analysis, often referred to as “herd behavior.”

- Characteristics: This behavior can lead to bubbles when the crowd is overly optimistic and crashes when the crowd panics.

Sharks:

- Meaning: In finance, a “shark” typically refers to an aggressive investor or trader who uses sharp, often predatory tactics to achieve profits. Sharks are known for their ability to exploit opportunities quickly and efficiently, often at the expense of other, less experienced investors.

- Symbolism: Sharks symbolize aggressiveness, opportunism, and a predatory nature in the market. They are often associated with practices like short selling, insider trading, or other high-risk strategies.

- Origins: The term likely originated from the predatory nature of sharks in the wild, which are apex predators known for their speed, strength, and efficiency in hunting.

Whales:

- Meaning: A “whale” in finance refers to an investor or trader with a large amount of capital who can influence the market due to the sheer size of their trades. Whales can be individuals, hedge funds, or institutional investors.

- Symbolism: Whales symbolize size and power. Their movements in the market can create significant waves, influencing prices and trends due to the large volume of assets they control.

- Origins: The term “whale” likely comes from the size and impact of actual whales in the ocean, symbolizing how large investors can make a big splash in the market.

Minnows:

The opposite of “whales” in the financial context would be “minnows.” While whales represent large investors or traders with significant capital and market influence, minnows refer to small investors with limited capital and minimal market impact.

- Meaning: Small investors or traders who hold relatively small positions in the market.

- Symbolism: They symbolize the smallest participants in the market, who are often seen as less powerful and vulnerable compared to larger players like whales. Minnows typically cannot move the market with their trades and often have to be more cautious due to their limited resources.

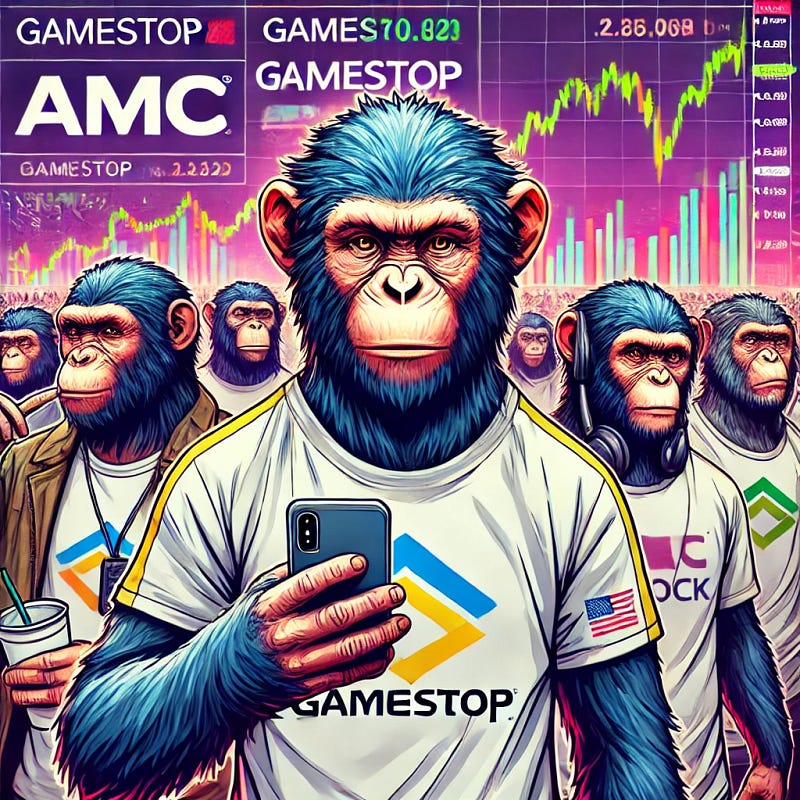

Apes (my personal favorite)

In the context of financial markets, “Apes” refer to retail investors who are part of the Reddit-driven investment communities, such as WallStreetBets. These investors famously rallied around stocks like GameStop (GME) and AMC Entertainment (AMC) in early 2021, driving up their prices in defiance of traditional financial institutions and hedge funds.

Characteristics:

- Collective Action: Apes are known for their coordinated buying efforts, often using social media platforms like Reddit to communicate and strategize. This collective action can lead to significant price movements in targeted stocks.

- Defiance Against Wall Street: The ape movement is characterized by a strong anti-establishment sentiment, with retail investors aiming to challenge and disrupt the practices of large hedge funds and institutional investors, particularly those involved in short selling.

- Long-Term Holding: Many apes advocate for “diamond hands,” a term that signifies holding onto stocks despite volatility and not selling during price drops.

- Community and Solidarity: Apes emphasize community support and solidarity, often using phrases like “Apes together strong” to highlight their collective strength and resolve.

Origin: The term “ape” originated from the WallStreetBets community on Reddit. It is a self-deprecating yet unifying label that members use to identify themselves, inspired by the notion that even “simple” retail investors (like apes) can achieve significant market impact through collective effort.

Examples:

- GameStop ($GME): In January 2021, the price of GameStop’s stock skyrocketed due to a coordinated effort by retail investors on Reddit. This movement aimed to trigger a short squeeze against hedge funds that had heavily shorted the stock.

- AMC Entertainment ($AMC): Similarly, AMC became a target for the ape movement, leading to substantial price increases as retail investors bought and held the stock, countering the short positions of institutional investors.

Impact: The ape movement demonstrated the power of retail investors to influence market dynamics, challenging the traditional dominance of institutional investors. It also brought attention to issues like market manipulation, short selling, and the democratization of financial markets.

Reasons for Using Animal Metaphors

- Relatability: Animals are universally recognized and their behaviors are easily understood, making complex financial concepts more accessible.

- Visualization: Animal behaviors provide clear, visual analogies for market movements and investor behaviors. For instance, the aggressive upward thrust of a bull or the cautious swiping of a bear can quickly convey market trends.

- Historical Context: Many of these metaphors have historical roots in agriculture and trade, where people’s livelihoods depended on animal behaviors. This historical linkage makes the metaphors more intuitive.

Conclusion

Animal metaphors in finance serve as powerful tools to explain market dynamics and investor psychology. They encapsulate complex behaviors in simple, vivid imagery, aiding in better understanding and communication of financial concepts. These metaphors highlight the various traits of market participants and the cyclical nature of markets.

References

- Investopedia: Bull Market

- Investopedia: Bear Market

- CNBC: The origin of bull and bear markets

- Investopedia: Greedy Pigs

- The Balance: Hawks and Doves

- ChatGPT (Custom GPT — “Financial Sage”)