I read an interesting article that was published in 2021 that gave me a bit of a different nuanced perspective of the housing crisis/bubble of the 2000s. As someone who studied the Great Recession in-depth, I was intrigued. The article was titled: The Housing Boom Was Greatly Exaggerated, Subheading: Almost everyone misunderstood the housing boom — including the Federal Reserve. I thought to myself, the nerve of this guy; how could the housing boom have been greatly exaggerated when it led to the biggest financial calamity since the Great Depression?

Almost everyone misunderstood the housing boom — including the Federal Reserve.

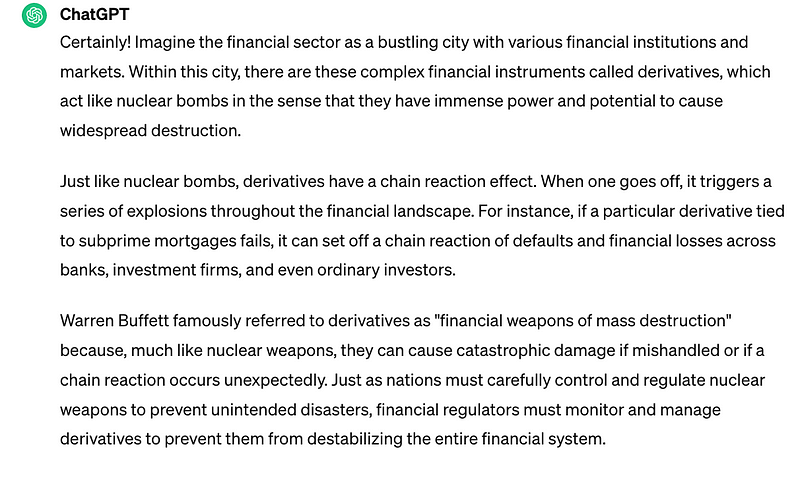

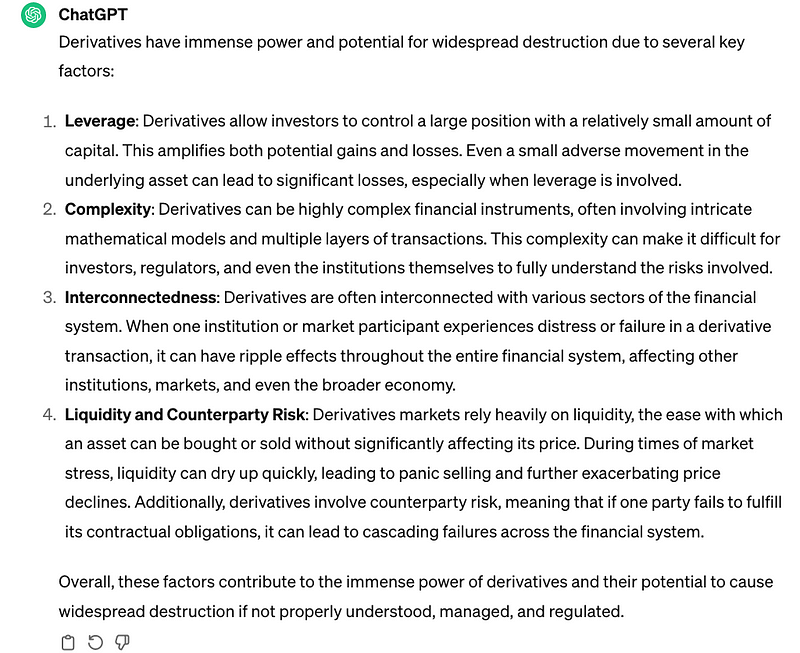

Then, I read it in its entirety, trying to grasp the graphs and arguments presented by the author. I found certain points that I already knew, such as the role of the Federal Reserve in boom and bust cycles. Yet he showed some very nuanced overview of the housing boom, and how it was misdiagnosed. While he only focused on the real estate side, such as the housing boom that occurred in some regions of the U.S. and around the world, my criticism would be that he left out the role of the financial sector, how interconnectedness it is, and the derivative bombs implanted and waiting to be detonated like a chain reaction to implode the system!

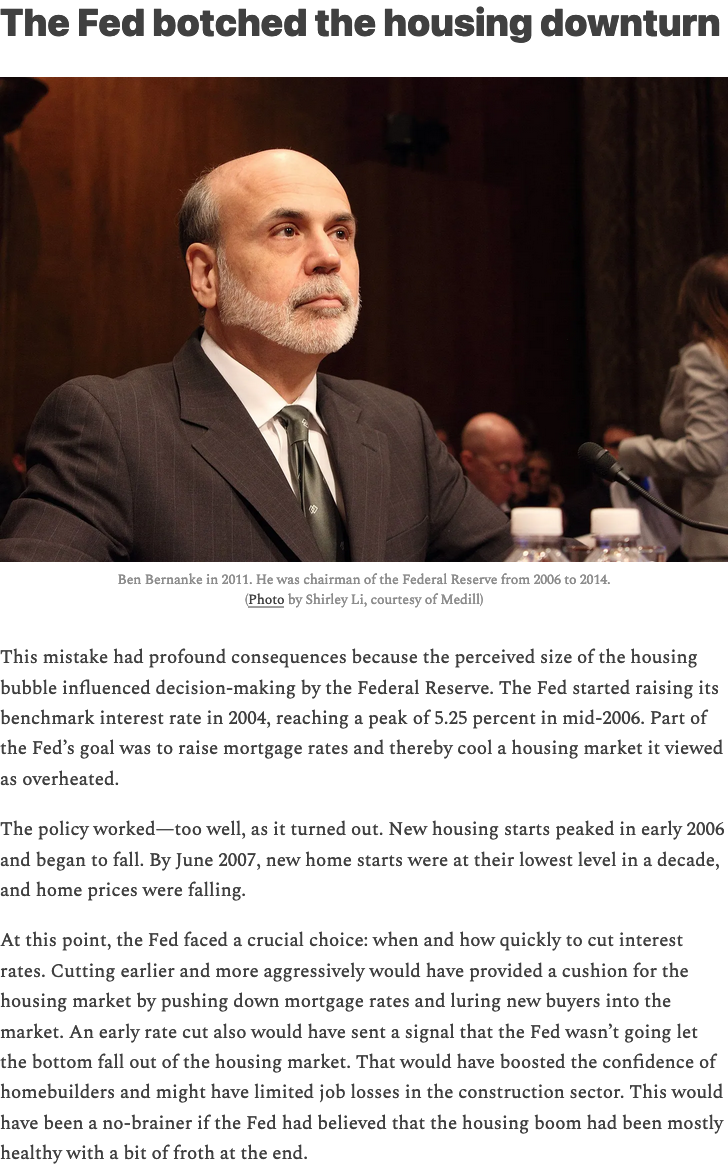

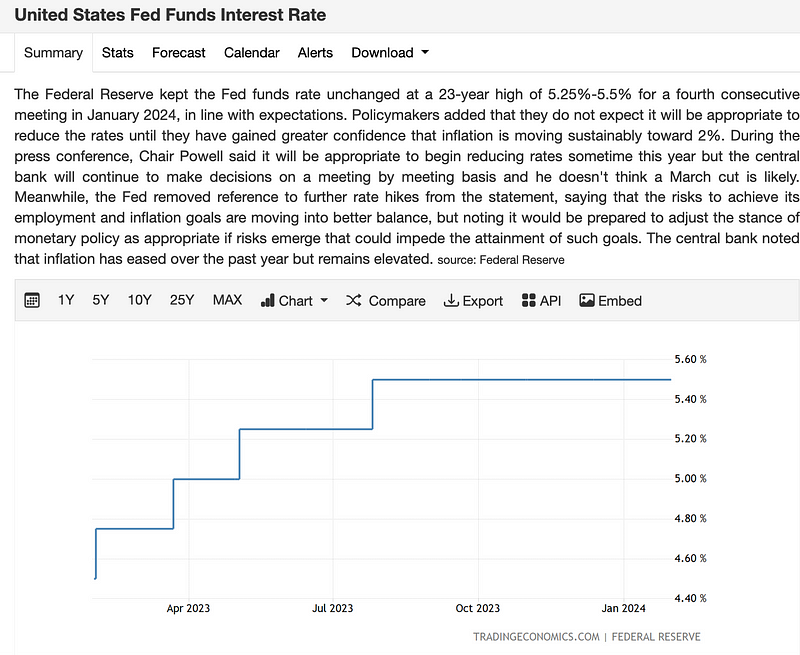

The section in the article about the Federal Reserve stood out to me.

“The Fed started raising its benchmark interest rate in 2004, reaching a peak of 5.25 percent in mid-2006. Part of the Fed’s goal was to raise mortgage rates and thereby cool a housing market it viewed as overheated.”

By this time, I started a bunch of Google searches and began to put the puzzle pieces together. Things started to click and make sense.

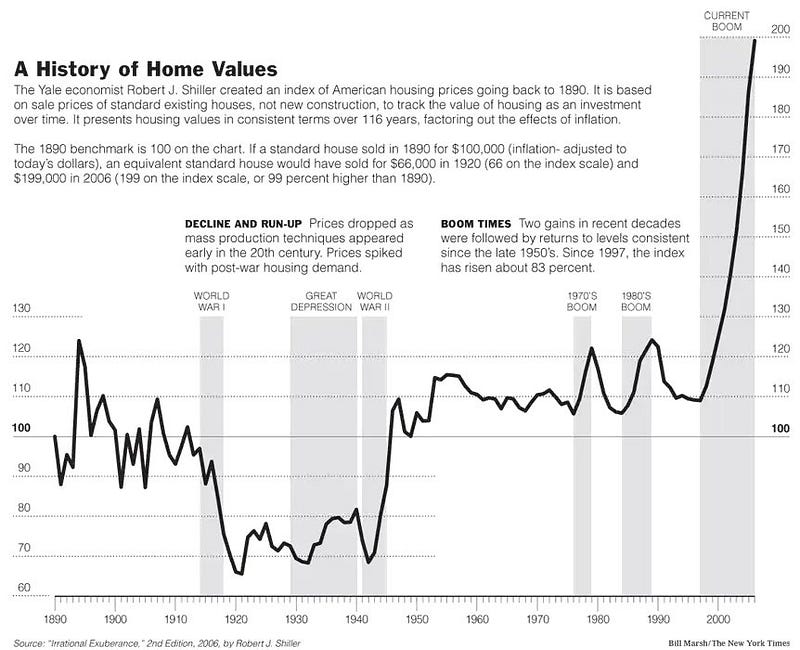

// One of the images shown in the article of a NYT graph from 2006:

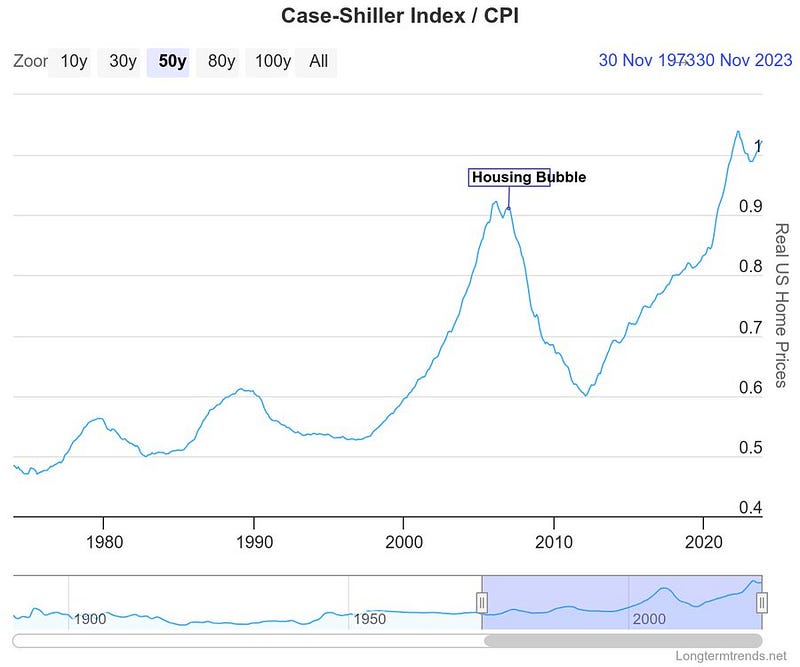

// I found this current graph [Case-Shiller Index/CPI]:

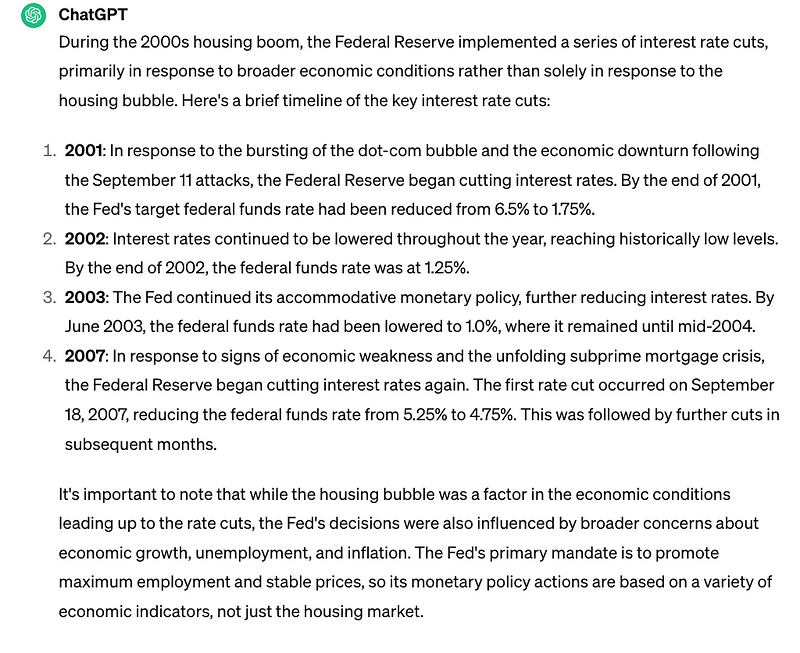

Now that we see the housing bubble is far above 2006 levels, wouldn’t it stand to reason that the continued sustained interest rates that we currently have in 2024 at 5.25% — 5.50% levels cause a sharp decline soon like it did in 2006?

The article, however, argues that fundamentals (like home shortages) were a driver of the housing price boom in certain regions of the U.S. and not necessarily driven by speculation. Be that as it may, if you believe speculation wasn’t a main factor of the housing bubble, then there is nothing to worry about this time around. Right?

Indeed, the economic and financial conditions are not the same as it was during the early 2000s, and the crises that followed. However, history tends to repeat with different rhythms. History will often repeat if we don’t learn from it. The same old story again!

Another condition to consider this time around is the commercial real estate sector. This has been all over the news, and articles of the risk of regional banks collapsing for being heavily exposed to commercial real estate.

https://t.co/0fdADAv92X?source=post_page—–ee4101359af8—————————————

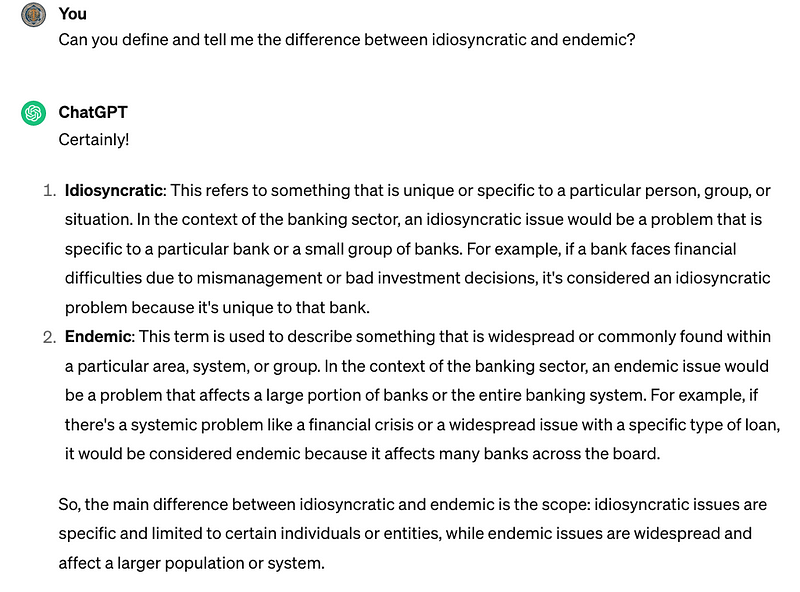

The Financial Times published a good video last month (January 2024) discussing some of the banking collapses like the Silicon Valley Bank that occurred in 2023. They point out something very important! The regulations and scrutiny of the banks that came after the 2008 financial crisis have led to the unintended consequences of shifting the risk from the “too big to fail” banks onto other entities — the shadow banking system (aka non-banks).

Description: “The banking sector survived two big shocks in 2023: the collapse of Silicon Valley Bank and the disaster-driven sale of Credit Suisse. Swift action prevented a global economic crisis but threats remain.”

The regulations and scrutiny to the banks that came after 2008 financial crisis has led to the unintended consequences of shifting the risk from the “too-big to fail” banks onto other entities — the shadow banking system (aka non-banks).

// A quick timeline to keep you up to speed on the pieces put together:

One should also consider the unintended consequences of the Federal Reserve’s decisions and repercussions after every interest rate hike and cut cycles to control the economy when it overheats and then kick-start it again when it has cooled down. The same cycle happened after the dotcom boom and bust, then the housing boom and bust.

In May of 1999, worried that the dot-com boom would fuel inflation, the Federal Reserve began raising rates from 4.74%.”

“The dot-com bubble burst in March 2000. By 2001, the bubble’s deflation was running full speed.” (ironic name).

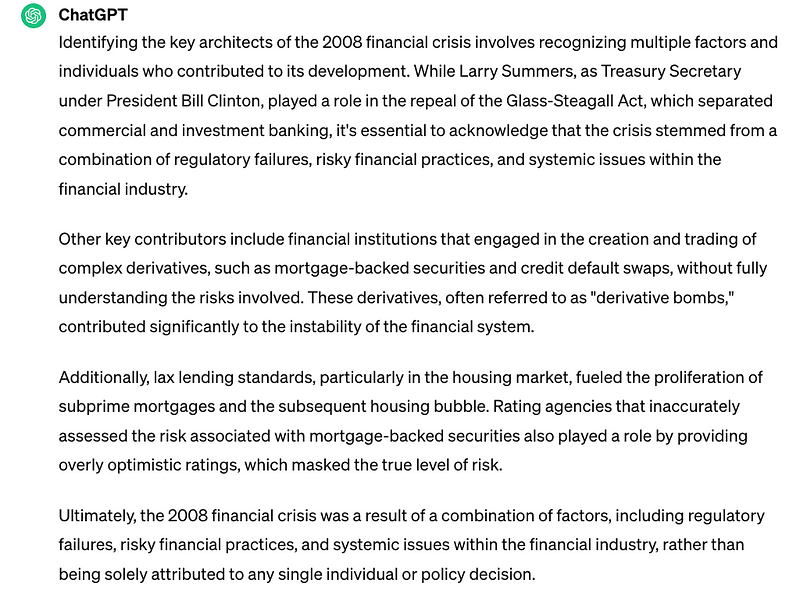

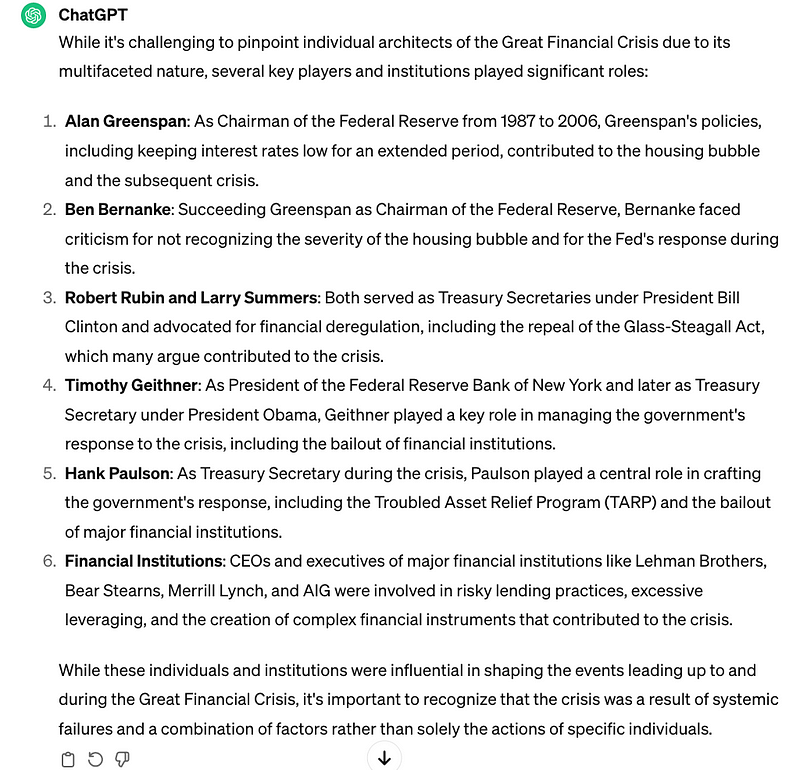

Following the burst of the dot-com bubble, the Federal Reserve reduced interest rates to stimulate the economy. As a result, economic conditions began to overheat once more, particularly evident in the soaring home prices in various regions of the United States. The Federal Reserve responded by gradually increasing its benchmark interest rate starting in 2004, peaking at 5.25 percent by mid-2006. One of the aims of this action was to elevate mortgage rates, thereby tempering what the Fed perceived as a scorching housing market. Meanwhile, complex financial instruments such as naked credit default swaps were lurking within the financial system, posing or signaling potential risks.

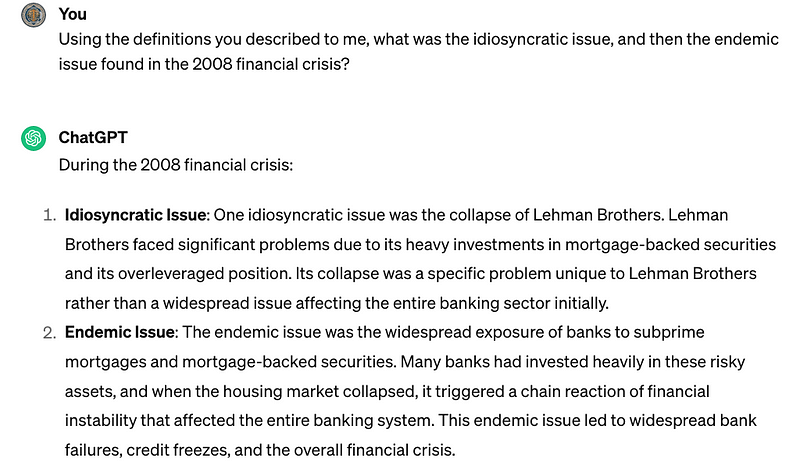

In 2006, the housing bubble reached its pinnacle before bursting, likely influenced by rising interest rates. This led to a sharp decline in home prices, triggering the bankruptcy filings of subprime lenders in early 2007. By the summer of 2007, additional significant cracks emerged, notably with the collapse of two hedge funds at Bear Stearns. Despite these warning signs, the Federal Reserve maintained interest rates at 5.25% until September 2007, when it began to cut rates.

Subsequently, the United States plunged into a severe recession, precipitating a global economic and financial crisis. Known as the 2007–2008 financial crisis or the Global Financial Crisis (GFC), it is the most severe worldwide economic downturn since the Great Depression.

Fast forward to post-pandemic.

From 2020 to 2023, the world grappled with the global pandemic, during which substantial stimulus packages were implemented, these two main factors led to a surge in inflation worldwide. (Affectionately referred to as “[Money printer says, ‘Brrr’]”).

The Fed last month (January) kept its policy rate in the 5.25% to 5.5% range, where it has been since last July, and while Fed Chair Jerome Powell noted progress, he also said March, when the policy-making committee next meets, would likely be too soon for the Fed to be sure it has won the fight with inflation.

The Current U.S. Federal Reserve Interest Rate:

This begs the question: What will happen between now and when the Fed begins cutting rates again? Will there be a “soft landing?” The worst-case scenario, a severe U.S. recession, combined with giant bank failures that cause systemic risk, may lead to a severe economic depression. Some believe that the Fed and the regulators are the problem for exacerbating risk-taking and systemic risk. At some point, the critics of government intervention or whom these critics mockingly call certain folks as regulatory evangelists) have to acknowledge that white-collar criminals, financial terrorists, and just regular old vice of greed, will continue to find loopholes to game the system (hello Archegos) that will likely put others in jeopardy for their own folly and greed.

Note: A lot of convergent moving factors and actors (e.g. policy decisions, individuals, and institutions) led to the 2008 Global Financial Crisis, not to mention the incestuous nature of the Power Elite — to quote C. Wright Mills, regulatory capture, and regulatory slashing (i.e., the repeal of Glass–Steagall in 1999). The cabal of those who write the rules, elect those in favor of their own rules, and then gaslight you for not understanding the system, will do everything in their power to stay in positions of high authority and status to maintain their tyranny of the status quo that is inflicted amongst the masses. In the long run, the 99% suffer while the 1% protect themselves.

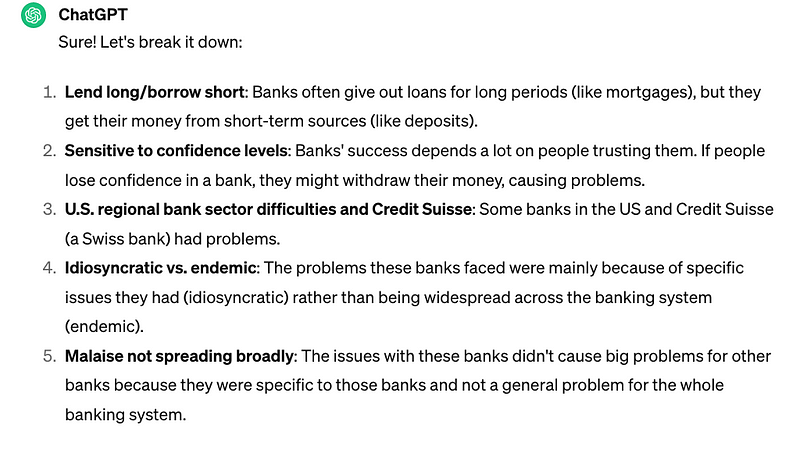

I commented on Dennis Kelliher’s post on X: “What is quite a paradox, or maybe I’m just puzzled by it, is how an idiosyncratic risk can also become an endemic issue. Maybe ChatGPT (3.5) is wrong here, or am I missing something, or am I misunderstanding?”

The semantics matter here…

“Hope for the best, and prepare for the worst.”