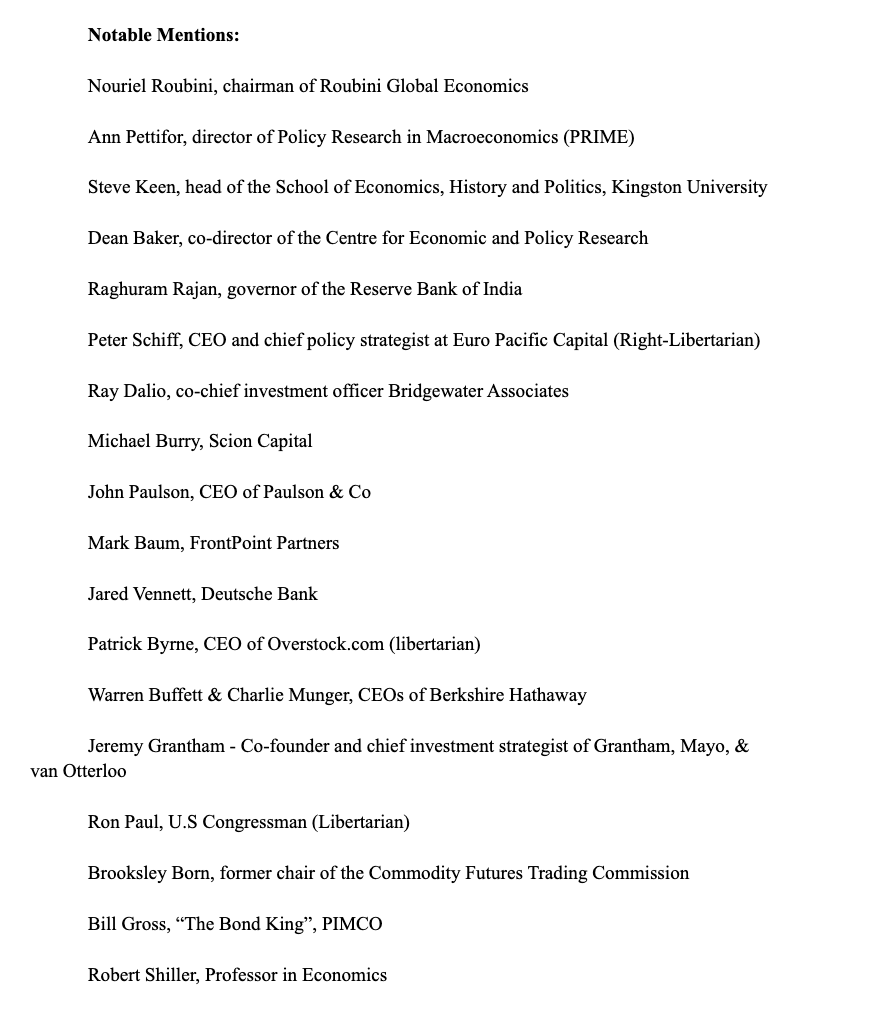

There were many who warned about a coming financial storm.

The housing crash that led to the Great Recession (2007-2009) was not a black swan event contrary to popular belief by the traditional media and many of those who occupy positions of power in the capital of the United States, Washington D.C. A black swan is an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences. Black swan events are characterized by their extreme rarity, severe impact, and the widespread insistence they were obvious in hindsight. I would slightly agree that it was difficult to forecast or predict the extent of how detrimental it would be in that time period and for years to come. However, some’ve warned and their warnings were not heeded.

Take for example the Yale professor of economics, Robert Shiller who saw the housing bubble building and predicted the housing market would burst by publishing academic and public articles a few years prior to the crash. What about Brooksley Born (former chair of the Commodity Futures Trading Commission) who said, “I was very concerned about the dark nature of these markets,” I didn’t think we knew enough about them. I was concerned about the lack of transparency and the lack of any tools for enforcement and the lack of prohibitions against fraud and manipulation.” Shiller and Born are two of many countless individuals who warned, yet no actions were taken. Granted, once the wheels were turning, momentum was building, and America was intoxicated by cheap money and easy credit, there was no turning back or hitting the breaks. It is like a drunk driver driving 100mph and the car in front of them makes a full complete stop. The drunk driver will inevitably crash and some of the vehicles behind will also not have enough time to hit the brakes, which is like the effects of falling dominos, or the domino effect*. Domino Effect Theory states that if one, often seemingly minor, event occurs, it will result in a series of chain events that have the potential to have disastrous consequences.

It is difficult to stop a financial storm because it is like a giant 1000 ft tsunami heading your way and you have only about 10 minutes to prepare to evacuate. The likelihood of you escaping is close to zero percent and you will likely never make it out in time. It is a reminder to do your own research, or due diligence if you will because those in positions of power or authority can and often will be wrong. It is not to say to distrust authority completely but to challenge (question) their claims. The media, whether social media or mainstream (traditional media) are conduits for a constant flow of information and they will get things right and wrong. You, the audience, as a reader or as a listener will sometimes have to decipher what is true and false to make the best decision.