There’s a huge discrepancy between the wealthy and some states’ plans with taxes. I’m reminded once again by the famous economist Milton Friedman’s many spot-on quotes, “people vote with their feet.” Rich people and big corporations aren’t stupid, they will go to other places where there are less or no taxes and more especially more freedom. We have people like the economist Peter Schiff who live in Puerto Rico. However, when there’s a mass influx of affluent people moving somewhere else to preserve their wealth, the unintended consequence includes segregating the communities over there. It is similar to how white flight happened in the 60s when white people fled out of the cities (which housed many blacks) and were also given pay assistance to move into suburban neighborhoods. A similar effect occurs with the gentrification in neighborhoods like in New York City where the cost of living and rents go higher with the influx of people moving in and pushing poorer people out or causing more economic and racial segregation.

The United States can’t seem to satisfy the wealthy or the working class. Recently, Elon Musk said Tesla headquarters would be leaving California (which was their last carmaker in the state) to Texas. On Twitter, a few state governors, senators, etc. were salivating at the chance of having a big corporation like Tesla in their state, and you can figure out why that is the case. A similar notion took place in New York where the Governor and Mayor of New York City were ecstatic at the chance of having Jeff Bezos company Amazon.com in their state but it received a large pushback from local residents.

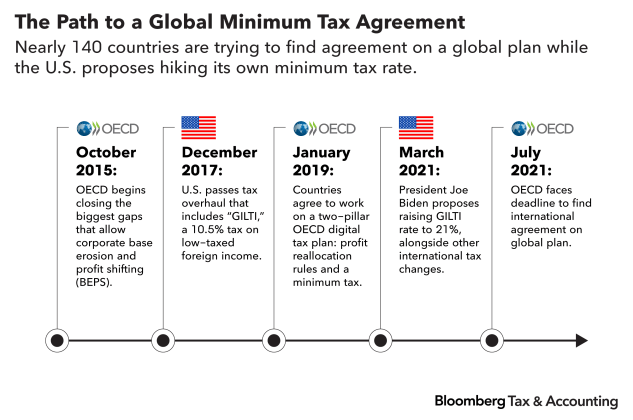

The Biden administration doesn’t seem to want to raise taxes on the working-class people. This year a global tax rate was a popular topic with Joe Biden, and Janet Yellen among others going on a global tour with a plan proposing a minimum global tax rate that would prevent tax havens and solve many issues. So far, one hundred and thirty countries are on board with this new tax rate proposal to prevent wealthy people and large corporations from avoiding taxes because the payment of the bills has to come from somewhere, and it sure as hell ain’t going to come from the government.

Of course, it is easier for someone with wealth to be mobile and leave where they want to go, the same can’t be said for a lot of others with fewer resources and opportunities. New York City and California are experiencing a mass exodus of people moving to different states like Texas and Florida despite some articles claiming these exodus rumors are false. In New York, billions were lost in taxes due to wealthy people leaving the city during the pandemic. Cathie Woods from Ark Invest is planning to move her investment firm from New York City to Florida. Yet, with all that being said, rents in many areas are going higher, the cost of living is higher, there’s rising inflation, a labor shortage issue vs. huge job openings, a supply chain issue, a huge debt crisis, the debt ceiling issue, a large political divide, and the list goes on and on like a never-ending chain reaction of entropy. The solutions to these issues are not as clear-cut and dry to figure out. It will take a giant political force of will to stop one issue from having a domino effect on others before it is too late.