The last time the United States, or the world for that matter had a global reset was during the biggest financial crisis in history, what is known as the Great Depression of the 1930s. The reset was needed because of the macroeconomics of the debt cycle that occurs every 75-100 years as hedge fund manager Ray Dalio mentioned numerous times. Take a look at the national debt and it is no wonder why the World Economic Forum’s new agenda is titled “The Great Reset.” The WEF stated on its website, “According to the Financial Times, global government debt has already reached its highest level in peacetime. Some countries have already used the COVID-19 crisis as an excuse to weaken environmental protections and enforcement. And frustrations over social ills like rising inequality – US billionaires’ combined wealth has increased during the crisis – are intensifying.”

https://www.usdebtclock.org/index.html

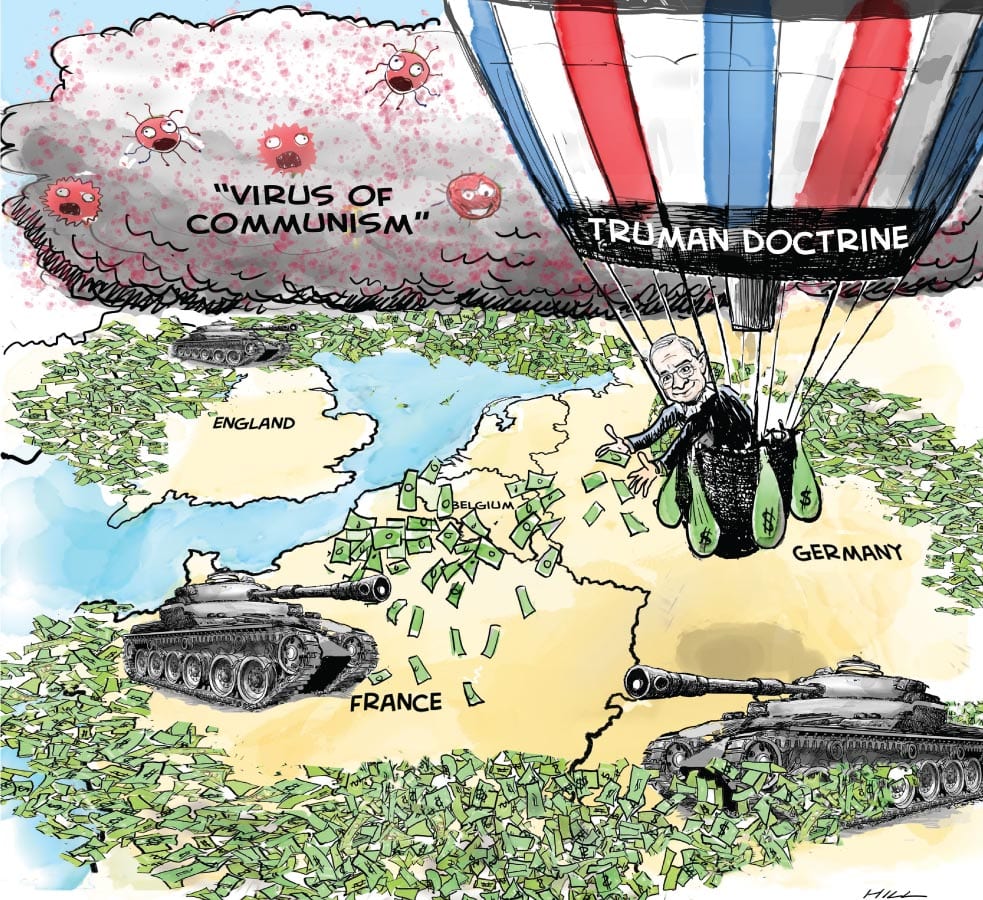

I’m a proponent of free trade, more globalization, and reformed capitalism. It is innovation that drives our economy, it is the working class that drives our economy, it is the global interdependence that keeps the world relatively peaceful compared to the less global trading that occurred in the early twentieth century, which led to economic/political strife, with the rise of fascist regimes in Italy and in Germany, and eventually WWII. Post-WWII, what followed was a host of conferences and policies to organize the world: The Bretton Woods System, The Truman Doctrine, multilateralism, the GATT, the IMF, and the role of U.S. hegemony. In essence, the creation of the New World Order to maintain peace. Soon after, this peace slowly eroded or diluted during the Cold War, and gradually strengthened thereafter… I say strengthened reluctantly because the attack on the World Trade Center in 2001 was a pivotal moment in time, it created new ethical and moral concerns within the U.S. government and reevaluated its dominance.

Another pivotal moment was the 2008 financial crisis that tanked the global economy. The over-complication of the system has ruined the stability of the financial market instead of just keeping it simple. On the other hand, more regulations were needed to close certain loopholes, the byproduct being the increase of this complexity. Like the human book, Charlie Munger said, if we didn’t allow it to begin in the first place we wouldn’t be in this mess, hence there would be no need for these new margin requirements. During the 1920s It was excess leverage (margin) where some people purchased stocks “on margin,” meaning they paid only a small percentage of the value and borrowed the rest from a bank or broker. This gamble played a major role in a list of compounding factors that caused the 1929 stock market crash which then led to the Great Depression. In more recent history, new financial instruments were created like credit default swaps which were a major factor that caused the 2007-2008 financial meltdown. These financial weapons of mass destruction were the doomsday clock or a ticking time bomb waiting to be detonated to collapse the global economy. Munger said It took the worst financial crisis of the 1930s for people to have some sense and for regulators to wisen up. This century was no different, where many people lost their homes, jobs, and life savings. This created much resentment, and the Occupy Wall Street movement emerged gaining worldwide support.

https://www.history.com/news/what-caused-the-stock-market-crash-of-1929

Greed always finds a way around regulations and creates new loopholes. It doesn’t help when there are entities that lobby for deregulation, and design less transparency making it harder for people to stop and crack down on the criminal behavior happening in the markets. Currently, China does not want any part of it, which is why they are cracking down on these gamblers to maintain their economic prosperity in a fair market. The article, China Is Cracking Down On Big Tech, Here’s Why, stated, “The social good is always emphasized, as defined and enforced by the Chinese government. From a Western point of view, such measures may seem a draconian violation of privacy and freedom. In China, however, they are generally lauded and welcomed. The prevailing view is tech firms may profit commercially from the exploitation of technology, but not at the expense of social good.” Perhaps this is what the U.S. is missing in its culture, somehow it has to maintain a balance of people’s self-interest with the collective well-being.

https://thenextweb.com/news/china-crackdown-big-tech-syndication

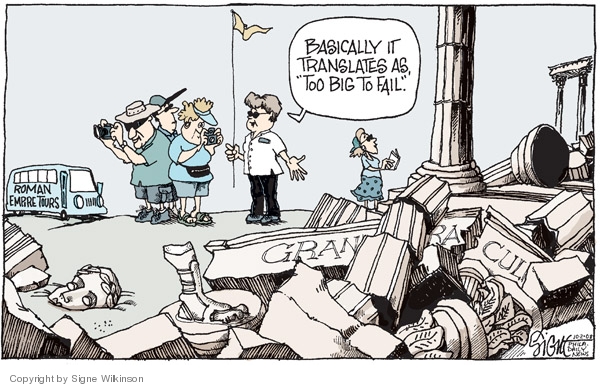

Keep in mind that in the U.S. many of the criminal activities are considered legal, where regulators like the SEC, FINRA, etc. have their hands tied behind their backs, with no way of punishing these swingers except by an unprecedented black swan event that evaporates them out of existence. In other words, let these big banks fail and go bankrupt. It gives a whole new perspective on the “too big to fail” notion that occurred with the bailouts of the 2008-12 recession, to what it should be now considered “too big to be tolerated.”

Now, I’m not an anarchist, Marxist, communist, socialist, left-wing, or right-wing; I’m a blank slate with no political affiliations, the closest political spectrum is dead center, with some influence of liberal ideals that closely resembles the libertarian party. Of course, even with this notion, I disassociate with the libertarian views because I believe in being independent, trying to see things critically and objectively, carefully assessing political actors arguing their peace, and then finding logical solutions. With that being said, I don’t mind rich people who created their wealth the honest way and don’t mind when corporations change their methods to keep the environment safe. Yet, it is no secret that the capitalist system has been polluted by those who extract it for all its worth, what is known as crooked or crony capitalism. These are parasites in our world that have become a national and global security threat for having taken hostage and control of nations. They have amassed large fortunes to control the fate of nations by selecting who gets elected into power, controlling what policies are put in place, extracted the wealth of nations that have put our economic system at risk. They will continue to extract natural resources to near extinction and have put the climate of the earth in jeopardy more than the good honest people collectively combined who play a factor in global warming. There’s little hope of getting rid of parasites, for they will always exist; the best we can do is mitigate their extraction and let them live comfortably in their habitat. The economic reset is upon us, time will only tell if we will be wise enough to handle the next few decades of this turbulent century.

“I fear a world where people are more concerned about obtaining financial freedom, rather than keeping economic stability.”